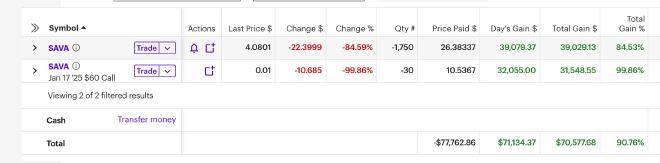

I’ll show proof first so you won’t think it’s bullshit.

Cassava’s story#

Saw this was Martin Shkreli’s biggest position on his stream.

Dug through some more YouTube videos and found the following facts:

- Founder quit recently

- Scientist got raided by the FBI

- Clinical and pre-trial data were fudged

- In a deeply-buried conference footage, phase 2 data was

p=0.48

There’s more going against their main drug, simufilam. But since p=0.48 is sufficient for me, I won’t belabor the details. If you want, go read this paper Shkreli put out.

Bottom line: their drug is fake, and you can make money shorting it.

Emotion vs. trade management & execution#

If the drug works, Cassava’s ($SAVA) stock should 6X+. If it doesn’t work, it should tank to its amount of cash (about $2).

Price was at $20s-$30s, so there’s a lot of room to short.

Entering the trade#

Phase 3 completed in October. Results were expected to be published by EOY.

Instead of shorting, I noticed $60 January calls were expensive. The great thing about selling calls vs shorting is that I win if either is true:

- Their drug fails

- They don’t publish results by EOY

Plan: Sell expensive calls ($8-$9 a pop when I entered, so about $800-$900 per contract). Eventually sold 35 contracts at an average of about $10.5 each. Or about $36,000.

Selling naked calls can incur infinite losses. So I bought weekly calls to insure against this.

The mechanics of this trade:

- Buy OTM calls expiring Friday.

- When Friday comes, roll my calls to the next Friday.

- Rinse/repeat until data comes out, or when my short calls expire

Risk considerations#

Naked short selling is dangerous.

Naked call selling is even more dangerous as these are leveraged shorts.

While I was confident this stock would drop when Phase 3 data comes, it’s possible for retail to run the stock up $100 without any new data. Example: Gamestop frenzy.

So, buying weekly calls to mitigate infinite losses is good insurance.

As theta is more intense, weekly calls at a lower strike ($30-$40) cost less than a higher strike ($60) with a January expiry.

Short calls have 8 weeks until expiry, so I can only profit if the cumulative weekly insurance is less than what I got for the call.

The big scare, and strategy pivot#

At first, the weeklies cost $1. And I can sell Jan calls at around $8-12. This is a good ratio as there was only around 8 weeks where I’d buy weeklies.

Big scare!#

On November 21st Thursday, the stock went up a lot. My short calls were down about $15K that day. If the frenzy continues, I can be looking at enormous losses.

This spike caused my next insurance purchase (Nov 29 expiry $40C) to be costly. They were $3 (dropped to $2 by EOD).

There are now 2 big sources of scare:

- Weekly calls get too expensive to insure against my losing Jan short calls.

- And speculators run up the price to way beyond $60.

In theory, my insurance should always be OK because any adverse price movements mean my weeklies can be rolled into the next week. It’s not like I have to buy new weeklies each week, just the difference between the one expiring today and the premiums for next week.

But pathological price movements stop this. Imagine you’re rolling $40 calls and each Thursday, it gets to $39. And each Friday, it drops to $30. Your 0DTE call will drop close to 0 due to theta. As the IV for next week’s $40C will remain high, you pay full price.

This price movement repeating itself leaves you taking massive losses.

Pivot#

I realized my January calls were not expensive enough. Per contract, its peak was selling at around $14/share.

My max gain here is only $1400 per 100 shares. And I’d need to keep buying $200-$400/week to ensure against this. I thought:

Wait a minute, but if I had 100 shares in regular shorts, my max gain is about $2800.

This makes the insurance 2X cheaper relative to my max gains. And as shorting common shares is less leveraged, I can go a little naked and skimp out on insurance some more.

The plan’s to:

- Slowly ease out of my -35 calls during days when the price dips.

- Start shorting shares when the price goes up.

- Be somewhat naked in the meantime.

I bought back 5 calls, totaling a $500 loss. This is why the screenshot above is -30 calls instead of -35. And shorted about 250 shares.

But before I can finish executing this plan, something amazing happened.

Last-minute shorting / infinite money glitch#

Cassava announced a press conference. As there was no other news, a press conference means that they have Phase 3 topline data available.

And this’ll be on Monday 8A ET.

Etrade opens Monday 7A ET for pre-market trading.

How these events work is they release their data sometime before the actual press conference (8A ET). If they release it way before 7A ET, I won’t be able to partake in more upside.

I looked around Robinhood and they don’t allow shorting. And my old IKBR account is disabled. Opening a new one takes a few business days, so I’m stuck with E-Trade.

7AM came and they haven’t released anything yet. So I shorted the stock pre-market. When asked how many shares I wanted to short, it felt like it was asking:

How much free money do you want today?

The reason why I was so confident and not hesitant is because I knew all the facts and had high conviction. It is physically impossible for the drug to work, and the company themselves have already published statistics saying so.

The 2nd reason why I was so confident is because the main risk of retail random-walking the stock up to $100 is gone now. There’s only minutes left. So anything I short is free money.

If I didn’t know so much about this drug, I would be much more risk-averse and probably would have fucked up the trade by being too conservative.

But just like in poker: Most hands you do nothing, but when you have the best hand, you try to extract max value.

So I shorted as many shares (in 500 lots) as my broker would let me.

My 1500 additional shares got allocated 15 minutes later (around 7:15 ET), and that contributed an extra $33K in profits.

The stock was halted at 7:25 ET for trading.

The news came out at 7:30 ET that the drug failed.

The stock resumed trading at 8:00 ET at $4.

Even though the screenshot above implies a $70K profit, about $4K was lost due to insurance costs + buying back the 5 contracts.

Mistakes and future improvements#

Instead of just selling calls, I should have also shorted. This would create more flexibility in my position.

With the timing of the news release on my side, I could have sold some VOO/VTI positions to raise extra liquidity, allowing for more shares to be shorted with my broker. I could have easily made an additional $320K if I had done that.

This is a very bad habit of mine that I am trying to change. Wins pay for losses, so the phrase

Nobody ever went broke taking a profit

isn’t true. Taking profits too early make it hard to pay for future losses. In this case, I covered at $4 and bought back the calls at $.01 (or $30). The $30 does not matter too much, but waiting for the stock to drop to $2 would have allowed for an extra $3500 or so in profits. This equates to a 35% gain in a $10K bet.

My thinking was “wow this is my biggest trade ever! I’m happy with this, time to close!”

When in fact, I could have just set up a 20-30% trailing stop loss and at least attempt to maximize profits.

I made the same mistake with $SMCI as well. It was at $17 and went up to $20, and I took profits. But if I had just set a 10% trailing stop, I would have doubled.

Epilogue: Sunk Cost#

I am not selling my $sava. Give me a few minutes and I will finish a writeup on why.

— Matt Nachtrab (@MattNachtrab) November 25, 2024

I am holding $sava still. Only "hedge" was I sold 3000 calls at $40 strike for Friday. I understand why most would give up on this. I want to see the analysis of the full data.

— Matt Nachtrab (@MattNachtrab) November 25, 2024

If you saw my recent tweets, I was concerned about the placebo being lower than the team expected… pic.twitter.com/5mjnKPFQGK

In case he deletes his tweet later, here’s the pertinent quotes:

I am not selling my $sava. Give me a few minutes and I will finish a writeup on why.

I am holding $sava still. Only "hedge" was I sold 3000 calls at $40 strike for Friday. I understand why most would give up on this.

Sounds like cope. Especially when p-value is 0.4+.

Just like in poker, it’s important not to tilt. People lose most of their chips and come back to have the biggest stack on the table all the time.

What’s worse is going all in until you lose all your money.

Sunk cost is sunk, and keeping your money in the thing that lost almost all your money is a terrible way to make the money back.

Basic reasoning says:

$10 million is better than $5 million. Better to take that money and do other plays than to wait for the stock to drop to $2.

Being down $60 million will trigger all sorts of psychological biases to further deepen losses.

And I find that thinking about the stock market like poker helps me distance myself from emotions. The former’s just a game with money, but thinking about it as “investing” makes the ego attached to it, allowing for costly psychological biases to sneak in.

But that’s another post.